Kansai Electric Power (KEPCO, Headquarters: Osaka Prefecture) announced on May 18, 2020, that the Hickory Run Thermal Power Plant, located in Pennsylvania State, U.S., has begun its commercial operations. KEPCO, Tyr Energy, and Siemens Financial Services (Headquarters: Munich, Germany)[1] jointly participated in the Hickory Run Thermal Power Plant Project in 2017, carrying out the investment and construction. KEPCO owns a 30 percent of share of the project.[2] Tyr Energy (Headquarters: Overland Park, Kansas) is a subsidiary of ITOCHU (Headquarters: Tokyo), one of the largest Japanese general trading companies[3], and invests in and develops independent power projects.[4]

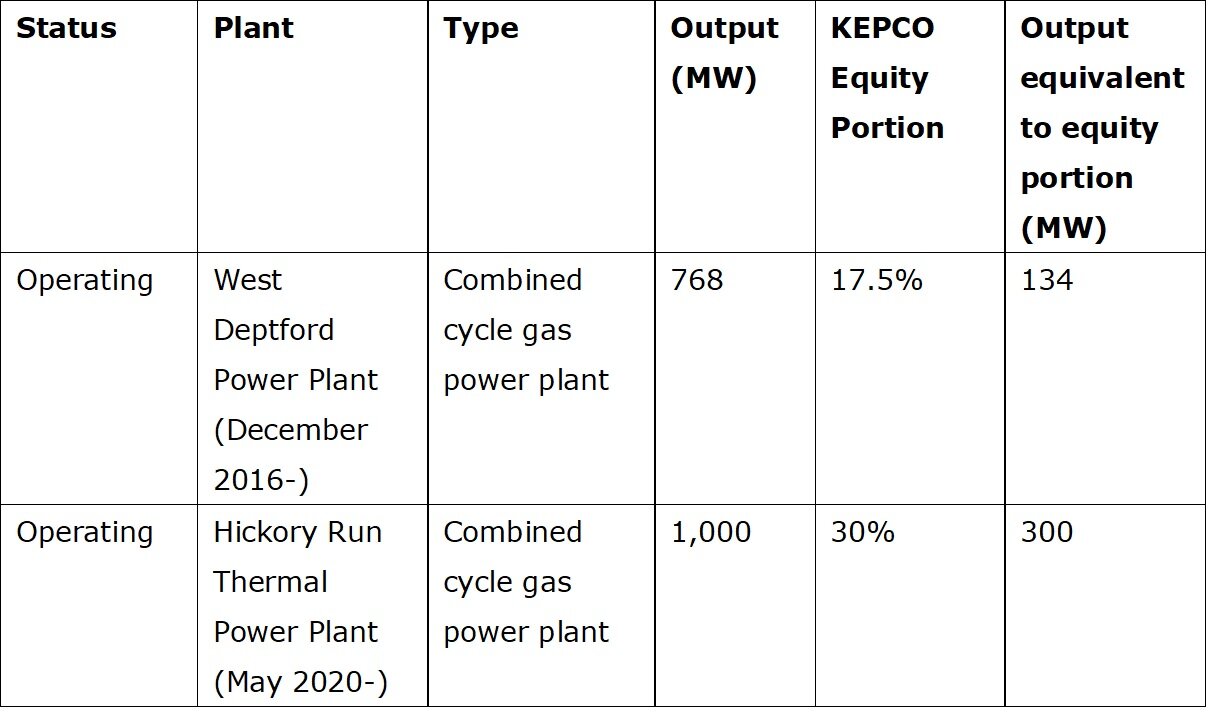

The Hickory Run Power Plant has adopted a combined cycle gas turbine generation with a capacity of 1,000MW. This is KEPCO’s first green field power project in North America. KEPCO dispatched experienced thermal engineers to the site during the construction stage to ensure the quality and efficiency of the process. The power plant will supply electricity to PJM (Pennsylvania-New Jersey-Maryland), which is the largest wholesale electricity market in North America. Now that the Hickory Run Power Plant is operating, the total capacity of KEPCO’s overseas power projects adds up to 2,606 GW.

Based on its Medium-Term Management Plan, overseas business is one of the important earnings pillars for KEPCO. KEPCO views North America as one of its most important markets, and aims to expand its businesses in the region.[5]

Overview of the Hickory Run Thermal Power Project[6]

(1) Site: North Beaver Township, Lawrence County, PA, U.S.A.

(2) Type: Combined Cycle

(3) Output: 1,000 MW

(4) Start of Construction: August, 2017

(5) Commercial Operation: May, 2020

(6) Project Company: Hickory Run Holdings, LLC

(7) Project Partners:

- Kansai Electric Power Group (Kansai):30%

- ITOCHU Corporation Group (Itochu):50%

- Siemens Group (Siemens):20%

◇ The Kansai Electric Power Co., Inc.

Establishment: 1951 President and Director: Takashi Morimoto Headquarters: 3-6-16, Nakanoshima, Kita-ku, Osaka, Japan Main Business: Energy generation, heat supply, telecommunications, gas supply, etc.

◇ ITOCHU Corporation

Establishment:1949 Chairman and CEO: Masahiro Okafuji Headquarters: 5-1 Kita-Aoyama 2-chome, Minato-ku, Tokyo, Japan Main Business: General trading company dealing in textiles, machinery, metals & minerals, energy & chemicals, food, general products & realty, ICT & financial business, etc.

◇ Siemens AG

Establishment: 1847 President and Chief Executive Officer: Joe Kaeser Headquarters: Munich, Germany Main Business: Building technology, digital factories, energy management, financial services, transportation, etc.