On September 12, 2022, BP announced that it has agreed to acquire EDF Energy Services (EDF ES), a retail power and gas provider, for an undisclosed amount. Based in Houston, Texas, EDF ES is a supplier of power, natural gas, and related services to commercial and industrial customers across the U.S. EDF ES’s customers are primarily large corporations and public entities, including retailers, universities, manufacturers and producers, municipalities, and power generators. Notably, it does not supply residential customers. BP said the deal will let it increase its capacity for lower carbon energy solutions. It is also the next step in the company’s goal to become an integrated energy company. EDF will integrate with other BP businesses that support decarbonization goals, such as BP Wind Energy, BP pulse, and BP Launchpad.

[World] Amazon on path to reach 100% renewable energy five years ahead of schedule

On April 20, 2022, Amazon announced that it has secured 37 new renewable energy projects totaling 3.5 GW of capacity, expanding the company’s renewable energy portfolio by nearly 30%.[1] The projects put the company on a path to reach 100% renewable energy by 2025, five years ahead of the original target of 2030. The projects are located across the U.S., Spain, France, Australia, Canada, India, Japan, and the United Arab Emirates. The projects include three wind farms, 26 solar farms, and eight rooftop solar installations. Twenty-three of these projects will be located in the U.S., spread out across 13 states. This includes a 500 MW solar farm in Texas, Amazon’s largest renewable energy project (by capacity) announced to date. The new projects also include a 300 MW solar project paired with 150 MW of battery storage in Arizona and a 150 MW solar project paired with 75 MW of battery storage in California. Amazon now has a total of 310 renewable energy projects, which, once operational, are expected to produce 42,000 gigawatt hours (GWh) of renewable energy annually.

[1] https://press.aboutamazon.com/news-releases/news-release-details/amazon-extends-position-worlds-largest-corporate-buyer-renewable

[USA] GE announces plans to split into three companies focused on Aviation, Healthcare, and Energy

General Electric (GE) announced on November 2, 2021, that it plans to split into three companies built around its major business units: aviation, healthcare, and energy.[1] According to the press release, GE Renewable Energy, GE Power, and GE Digital will combine and split off from the parent company in 2024, following the split of its healthcare unit company in 2023. The new energy company will encompass equipment and services for gas, coal, wind, hydropower, and nuclear power generation. It will also include renewables and digital software operations. Following the split-off of healthcare and energy, GE will be an aviation-focused company only. GE’s press release claims that the “businesses will be better positioned to deliver long-term growth and create value for customers, investors, and employees.” GE shares reached a 3-1/2 year high following the announcement, rising more than 2.6%.[2]

[1] https://www.ge.com/news/press-releases/ge-plans-to-form-three-public-companies-focused-on-growth-sectors-of-aviation

[2] https://www.reuters.com/business/sustainable-business/ge-energy-spinoff-aims-capture-interest-renewables-2021-11-09/

[USA] ADNOC sells first blue ammonia cargo to Japan's Itochu

On August 3, 2021, Abu Dubai National Oil Company (ADNOC), the state-owned oil company of the UAE, announced that, in partnership with Fertiglobe, it had sold its first blue ammonia cargo to Itochu in Japan to be used in fertilizer production.[1] The agreement builds upon the Japanese Ministry of Economy, Trade and Industry's (METI) first fuel ammonia deal in cooperation with ADNOC in January 2021 to support the development of new UAE-Japan blue ammonia supply chains. Blue ammonia can be used as a low-carbon fuel in many different industrial applications, including transportation, power generation, and steel production, among other things. As a carrier fuel for hydrogen, which is hard to transport in its natural state, blue ammonia is expected to play an important part in Japan’s ongoing efforts to decarbonize its industrial sector.

In a statement, Masaya Tanaka, Executive Officer of Itochu Corp, said, "Starting with this trial of blue ammonia for fertilizer applications, we aim to create a wide range of ammonia value chains for existing industrial applications as well as future energy use. By collaborating with ADNOC and Fertiglobe, we expect to initiate and enhance our industrial portfolio in the fertilizer sector while achieving our commitments towards decarbonization activities in other industries."

Fertiglobe, a 58:42 partnership between Dutch chemicals company OCI and ADNOC, will produce blue ammonia at its Fertil plant in the Ruwais Industrial Complex in Abu Dhabi for delivery to ADNOC's customers in Japan. The Fertil plant has a production capacity of 1.2 million mt/year of ammonia and 2.1 million mt/year of urea. While the plant produces ammonia that is usually defined as “grey” ammonia, it will be fitted with CO2 liquefaction units. CO2 will then be transferred to and reinjected into underground reservoirs by the ADNOC Al Reyadah carbon capture and storage (CCUS) plant to enable the production of blue ammonia.

[1] https://www.adnoc.ae/en/news-and-media/press-releases/2021/adnoc-and-fertiglobe-partner-to-sell-uaes-first-blue-ammonia

[Japan] Daigas Group Released its Carbon Neutral Vision to achieve the 2050 Carbon Neutrality Action Plan

On January 25, 2021, Daigas Group (Daigas, Headquarters: Osaka), Osaka Gas’s parent company, released its Carbon Neutral Vision (the Vision), as part of its contribution to the national goal of achieving carbon neutrality by 2050.

In the Vision, Daigas underscores the importance of the reduction of CO2 emissions, since technological innovation to achieve carbon neutrality will require significant time and tremendous social costs. The Vision lays out targets to achieve Daigas’ goals and action targets by 2030 as follows:

· Increase its renewable energy deployment to reach a total of 5GW[1] (inside and outside Japan) by developing and owning their energy sources, as well as promoting procurement from others

· Aim to increase Daigas’ renewable energy share to approximately 50% of the company’s domestic energy portfolio

· Reduce annual CO2 emissions from 33 million tons to 10 million tons

Daigas has already contributed to a wide range of research and development activities on the latest technologies, including methanation and hydrogen production technologies. Based on the Vision, Daigas plans to 1) build a hydrogen energy network; 2) decarbonize the CO2 emissions of its gas business by utilizing methanation technology; and 3) reduce the CO2 emissions of its electric generation business by expanding the use of renewable energy. With its new Vision, Daigas will continue to accelerate research and development activities by promoting alliances with various industry-government-academia partner companies.[2]

[1] As of December 2020, the total amount of renewable energy sources that had already been developed was approximately 0.7 GW, including wind, solar, and biomass, both inside and outside Japan.

[2] https://www.osakagas.co.jp/company/press/pr2021/1291446_46443.html

[Japan] Keidanren Released the “New Growth Strategy”

Keidanren, also known as Japan Business Federation, released a “New Growth Strategy” on November 17, 2020 describing its action targets for 2030 in several areas. Keidanren is an economic organization that represents 1,444 domestic companies, 109 nationwide industrial associations, and 47 of Japan’s regional economic organizations (as of April 1, 2020).[1]

The New Growth Strategy focuses on sustainable capitalism, and urges Japanese companies to address various environmental, societal, and economic challenges that have worsened due to the COVID-19 pandemic. The Strategy lays out vision and action targets for 2030 in each of the five following areas: (1) achieving new growth through digital transformation (DX), which aligns with one of the priorities of the newly established Suga administration; (2) reforming the traditional time-based work management to allow various work styles; (3) regional revitalization; (4) rebuilding the international economic order, and 5) achieving green growth.

As part of the mission to achieve green growth, the Strategy has addressed the importance for Japan to take the following measures in order to become carbon-neutral by 2050, which is the goal established in Prime Minister Suga's recent policy speech:

1) Accelerating innovation towards a carbon-free society: promoting innovations such as battery storage, hydrogen, and carbon capture utilization and storage (CCUS); supporting innovation through public-private partnerships (PPP); and addressing challenges through the Challenge Zero[2] project;

2) Prioritizing support for the development of renewable energy: developing policy measures, infrastructure and supply chain to accelerate the installation of renewable energy that is expected to be cost competitive and can be installed at a large scale, such as rooftop solar power and large-scale offshore wind power;

3) Utilizing nuclear power that can achieve both decarbonization and economic efficiency: facilitate the restart of existing nuclear power plants and the development of advanced nuclear reactors while improving safety and building public acceptance;

4) Accelerating electrification: promote the electrification of homes, office buildings, and cars; encourage investment in Japan’s energy sector by facilitating the creation of large-scale power demand such as data centers; and

5) Formation of the Green Growth National Alliance: lead the formation of a Green Growth National Alliance and introduce a wide range of green technologies while promoting sustainable financing.

Keidanren noted that Japan faces various energy challenges, particularly since the Fukushima accident in 2011. The investment required to comply with new safety measures for nuclear power plants has made it difficult for utilities to invest in new energy technologies in the last decade. Keidanrenemphasized the importance of creating a mechanism to promote investment in green innovation in order to meet Japan’s carbon-neutral goals.[3] [4]

[1] https://www.keidanren.or.jp/profile/pro001.html

[2] In June 2020, Keidanren launched the Challenge Zero Project in order to accelerate the transition towards a low-carbon society. Under the Challenge Zero Project, the member companies and groups have set their own goals to tackle a total of 305 innovation challenges.

[3] https://www.keidanren.or.jp/speech/kaiken/2020/1109.html

[Japan] JERA announces retirement of its inefficient coal plants by 2030; goal of achieving net zero emissions by 2050

On October 13, 2020, JERA, On October 13, 2020, JERA (a joint venture between Tokyo Electric Power Fuel & Power (headquarters: Tokyo) and Chubu Electric Power (Headquarters: Nagoya City, Aichi Prefecture)), announced that it will shut down all of its inefficient coal-fired power plants in Japan by 2030.[1] Shuttering inefficient coal plants is in line with the Japanese government’s policy, but this is the first time that a power company has announced that it will match that policy. The Japanese government has not set a definition of an inefficient coal-fired plant, but JERA said it sees inefficient plants as power plants that use “supercritical or less” technology. The company declined to say how many coal plants it will be closing due to competitive concerns.

JERA also announced that it aims to achieve net zero carbon emissions by 2050 to tackle climate change. To achieve this target, JERA plans to expand renewable energy through offshore wind farms while also using greener fuels like ammonia and hydrogen at its thermal power plants. The company intends to start a pilot program to use ammonia as a fuel with coal in mixed combustion at its Hekinan thermal power station in central Japan by 2030 and hopes to achieve 20% use of ammonia at its coal-fired power plants by 2035. Other measures of the plan include improving efficiency of gas-fired power plants and burning hydrogen in mixed combustion at gas-fired power stations.

[1] https://www.japantimes.co.jp/news/2020/10/13/national/power-firm-jera-shut-inefficient-coal-fired-plants-2030/

[USA] Ameren announces commitment to net-zero carbon emissions by 2050

On September 28, 2020, Ameren Missouri announced a new commitment to net-zero carbon dioxide emissions by 2050, with interim goals of 50% emissions reduction in 2030 compared to 2005 levels and 85% emissions reduction by 2040 compared to 2005 levels.[1] The commitment is an update to the targets it set in 2017— 35% reduction by 2030, 50% reduction by 2040, and 80% reduction by 2050. According to the utility, the move is primarily guided by investors and customers. Ameren’s new plan allocates approximately $4.5 billion over the next decade to add 3.1 GW of new wind and solar to its portfolio. By 2040, the utility expects to have 5.4 GW of renewables in its portfolio. Under this plan, the utility will retire its 5 GW og coal-fired generation by 2042: Meramec Energy Center by the end of 2022, the Sioux Energy Center by the end of 2028, two units at the Labadie Energy Center by the end of 2036, both units at the Rush Island Energy Center by the end of 2039, and the remaining two units at the Labadie Energy Center by the end of 2042. The plan also assumes that the operating license for Ameren’s Callaway nuclear facility is extended beyond 2050.

[1] https://www.ameren.com/-/media/missouri-site/files/environment/irp/2020/ch1-executive-summary.pdf?la=en-us-mo&hash=67ECB83304090AE189E1528AABDD2211E5A091BC

[USA] Vistra announces plan to retirement of its Midwest coal fleet by 2027

Vistra, a competitive energy supplier headquartered in Irving, Texas, announced on September 29, 2020 that it would retire its entire Midwest coal fleet, about 6.8 GW of energy, by 2027.[1] The company currently owns seven coal-fired power plants across the Midwest and would retire the majority of its plants through 2025-2027, though the company commented that the retirements could be sooner if it is more economic to do so. According to Vistra, the coal plants, especially the one operating in the “irreparably dysfunctional” Midcontinent Independent System Operator (MISO) market, are economically challenged. Additionally, upcoming Environmental Protection Agency (EPA) filing deadlines would require either significant capital expenditures for compliance or retirement declarations.

Vistra also announced the launch of Vistra Zero, a portfolio of zero-carbon power generation facilities. Under Vistra Zero, the company is breaking ground on six new solar projects and one battery energy storage project, which total nearly 1,000 MW. These projects will be online by 2022 and are all located in the Electric Reliability Council of Texas (ERCOT) market. Additionally, the company announced new greenhouse gas emissions reduction targets. Vistra is now setting out to achieve a 60% reduction, up from 50%, in carbon emissions by 2030, and a long-term objective to achieve net-zero carbon emissions, up from an 80% reduction target, by 2050.

[1] https://investor.vistracorp.com/investor-relations/news/press-release-details/2020/Vistra-Accelerates-Pivot-to-Invest-in-Clean-Energy-and-Combat-Climate-Change/default.aspx

[USA] PSEG to explore strategic alternatives for its non-nuclear fleet

During its second quarter earnings conference call on July 31, 2020, New Jersey utility Public Service Enterprise Group (PSEG) announced that it is “exploring strategic alternatives” to PSEG Power’s, a subsidiary of PSEG, non-nuclear generating fleet.[1] This includes 6,750 MW of fossil generation located in New Jersey, Connecticut, New York and Maryland and its 467 MW Solar Source portfolio spread across 14 states. According to CEO Ralph Izzo, PSEG expects the sale of its fossil fuel portfolio to begin in late 2020 and be completed in 2021. PSEG intends to retain ownership of PSEG Power’s existing nuclear fleet. Izzo said the move to exit merchant generation while retaining nuclear power “could reduce overall business risk and earnings volatility, improve our credit profile and enhance an already compelling [environmental, social and governance] position driven by pending clean energy investments, methane reduction and zero-carbon generation.” In addition to keeping its existing nuclear fleet, PSEG says that it is evaluating potential investments in offshore wind and considering participation in upcoming offshore wind solicitations in New Jersey and other Mid-Atlantic states. The utility expects to decide on whether to invest in Ørsted's Ocean Wind project by the end of 2020.

[1] https://www.prnewswire.com/news-releases/pseg-to-explore-strategic-alternatives-for-pseg-powers-non-nuclear-fleet-301103791.html

[Japan] J-Power Consolidates its Thermal Power Generation and Service under J-POWER Generation Service

Tokyo-based Japanese power producer J-Power announced on June 25, 2020, that it will transfer the operation of its thermal power generation plants to JPEC (Headquarters: Tokyo).[1] JPEC is J-Power’s wholly owned subsidiary that provides construction and maintenance services for power generation equipment.[2] JEPC will be renamed J-POWER Generation Service to reflect this change.

Since 2004, J-Power and JPEC have shared responsibility of operations and maintenance (O&M) of thermal power plants. However, in response to the rising competition introduced by the deregulation of the electricity market, J-Power plans to streamline its businesses to improve efficiency and reduce the cost of O&M by consolidating O&M under J-POWER Generation Service. In the long term, J-Power plans to strengthen its investment in renewable energy and overseas business development.

Starting in August 2020, the O&M for seven of J-Power’s Thermal Power Plants will be managed by J-POWER Generation Service. J-Power will integrate its Thermal Power Generation Department and Thermal Power Construction Department into the Thermal Energy Department, which will be responsible for developing the company’s strategy for thermal generation and maintaining and improving the thermal generation technology. J-Power will continue to be responsible for fuel supply and electricity sales. [3]

[1] https://www.jpec.co.jp/company/index.html

[2] https://www.jpec.co.jp/service/index.html

[3] https://www.jpower.co.jp/news_release/2020/06/news200625_4.html

[USA] Sunrun strikes deal to acquire Vivint Solar for $1.46 billion

Sunrun, the largest residential solar company in the U.S., announced on July 6, 2020 that it has struck a deal to acquire residential energy competitor Vivint Solar, the second largest residential solar company in the U.S., for about $1.46 billion in an all-stock deal, a type acquisition where shareholders of the acquired company receive shares in the acquiring company as payment rather than cash.[1] Sunrun offers energy storage and grid services, working directly with utilities and grid operators. Vivint targets customers through direct-to-home sales which eases customer access to services and drives product purchases. Sunrun shareholders will hold about 64% of the combined company. The deal is expected to deliver about $90 million in annual cost savings between the companies. Based on Sunrun’s stock price on July 6, 2020, the combined entity will be valued at approximately $9.2 billion. In a statement regarding the acquisition, Sunrun said, "We expect to benefit from efficiencies in large scale project finance capital raising activities and are excited about the opportunity to build an even stronger and more recognizable consumer brand in residential energy services.”

[1] https://investors.sunrun.com/news-events/press-releases/detail/207/sunrun-announces-definitive-agreement-to-acquire-vivint

[Japan] Japan Business Federation Launched the Challenge Zero Project

Amid concerns about climate change, the Japan Business Federation, also known as Keidanren, announced on June 8, 2020 that it had launched the Challenge Zero Project in order to accelerate the transition towards a low-carbon society. Keidanren is an economic organization that represents a membership comprised of 1,444 domestic companies, 109 nationwide industrial associations, and 47 of Japan’s regional economic organizations (as of April 1, 2020).

The Challenge Zero Project has been endorsed by over 130 participating companies and groups, ranging from energy companies and utilities to manufacturers, financial institutions, and retailers. Among them, some Japanese utilities and energy producers are part of the project: Tokyo Electric Power Company Holdings (TEPCO, Headquarters: Tokyo), Chubu Electric Power (Chuden, Headquarters: Nagoya City, Aichi Prefecture), Kansai Electric Power (KEPCO, Headquarters: Osaka City, Osaka Prefecture), Chugoku Electric Power (EnerGia, Headquarters: Hiroshima City, Hiroshima Prefecture), Okinawa Electric Power (OEPC, Headquarters: Urasoe City, Okinawa Prefecture), and Electric Power Development Company (J-POWER, Headquarters: Tokyo).[1]

Under the Challenge Zero Project, the member companies and groups have set their own goals to tackle a total of 305 innovation challenges. Challenges are different for each member, such as developing CO2 utilization technology, improving the efficiency of reusing Electric Vehicles’ (EV) batteries, etc.[2] Keidaren and participating entities aim to contribute to CO2 emission reductions by addressing these challenges.[3] [4]

[1] https://www.challenge-zero.jp/jp/member/

[2] https://www.challenge-zero.jp/jp/casestudy/

[3] https://www.keidanren.or.jp/policy/2020/052.html

[4] https://www.challenge-zero.jp/jp/about/

[USA] Vectren Energy announces plans to reduce coal mix 78% to 12% by 2025

On June 15, 2020, Vectren Energy, a subsidiary of CenterPoint Energy based in Indiana and parts of Ohio, announced it would retire 730 MW of coal by 2030 which would bring its resource mix to 12% coal-fired power by 2025.[1] As of 2020, the utility’s generation portfolio is 78% coal. Under Vectren’s preferred integrated resource plan (IRP), which is based on an all-resource request for proposals, the utility would add 700 MW to 1000 MW of solar+storage, 300 MW of wind, 30 MW of demand response resources and 460 MW of combustion turbine natural gas plants. In total, the mix would be 64% renewable energy plus demand response by 2025. According to Vectren, the proposed plan is expected to reduce greenhouse gas emissions (GHG) 75% below 2005 levels by 2035 and save customers up to $320 million over the next 20 years.

In recent years, the utility has been under pressure from state legislators to keep Indiana coal online. In 2019, Indiana lawmakers proposed legislation that would place a moratorium on new resources in the state in order to protect coal-fired power from getting replaced.[2] Though the bill failed in the 2019 legislative session, in early 2020 lawmakers passed House Bill 1414 which makes coal plants in the state more difficult to retire.[3] Vectren’s new plan, though, bucks these pressures.

[1] https://www.centerpointenergy.com/en-us/corporate/about-us/news/1348

[2] http://iga.in.gov/documents/b14c355b

[3] https://legiscan.com/IN/bill/HB1414/2020

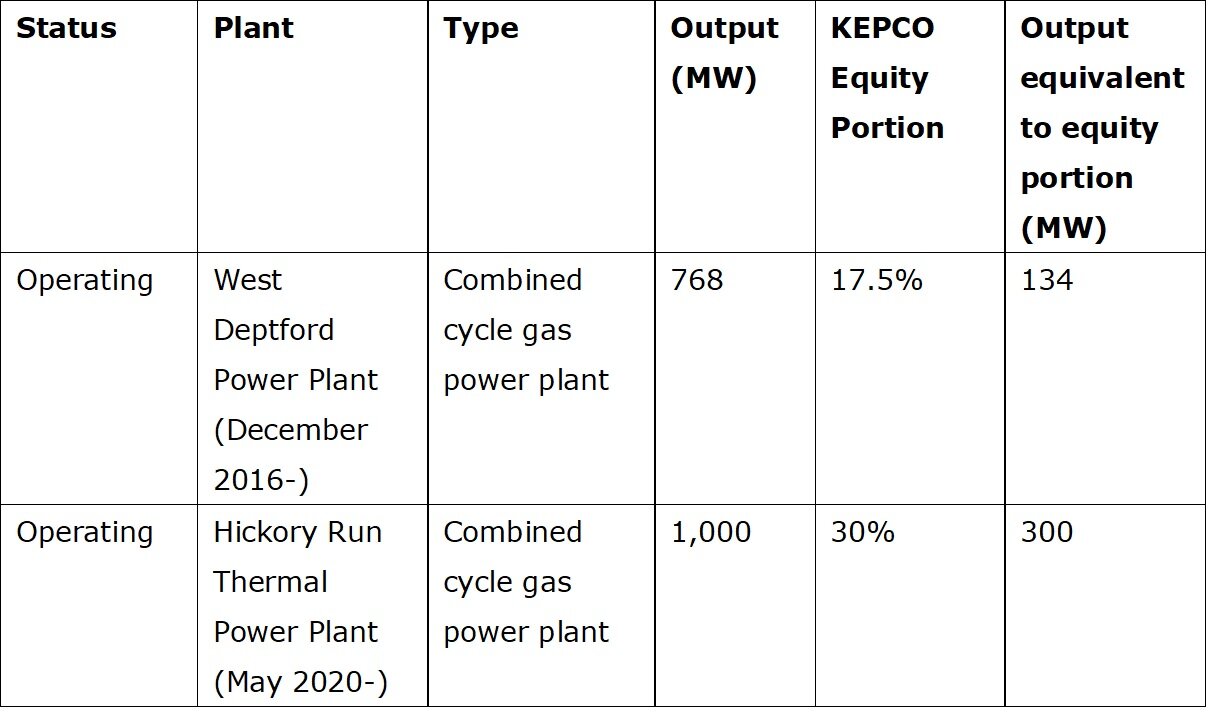

[Japan] Kansai Electric Power Began Commercial Operation of Hickory Run Thermal Power Plant in the U.S.

Kansai Electric Power (KEPCO, Headquarters: Osaka Prefecture) announced on May 18, 2020, that the Hickory Run Thermal Power Plant, located in Pennsylvania State, U.S., has begun its commercial operations. KEPCO, Tyr Energy, and Siemens Financial Services (Headquarters: Munich, Germany)[1] jointly participated in the Hickory Run Thermal Power Plant Project in 2017, carrying out the investment and construction. KEPCO owns a 30 percent of share of the project.[2] Tyr Energy (Headquarters: Overland Park, Kansas) is a subsidiary of ITOCHU (Headquarters: Tokyo), one of the largest Japanese general trading companies[3], and invests in and develops independent power projects.[4]

The Hickory Run Power Plant has adopted a combined cycle gas turbine generation with a capacity of 1,000MW. This is KEPCO’s first green field power project in North America. KEPCO dispatched experienced thermal engineers to the site during the construction stage to ensure the quality and efficiency of the process. The power plant will supply electricity to PJM (Pennsylvania-New Jersey-Maryland), which is the largest wholesale electricity market in North America. Now that the Hickory Run Power Plant is operating, the total capacity of KEPCO’s overseas power projects adds up to 2,606 GW.

Based on its Medium-Term Management Plan, overseas business is one of the important earnings pillars for KEPCO. KEPCO views North America as one of its most important markets, and aims to expand its businesses in the region.[5]

Overview of the Hickory Run Thermal Power Project[6]

(1) Site: North Beaver Township, Lawrence County, PA, U.S.A.

(2) Type: Combined Cycle

(3) Output: 1,000 MW

(4) Start of Construction: August, 2017

(5) Commercial Operation: May, 2020

(6) Project Company: Hickory Run Holdings, LLC

(7) Project Partners:

- Kansai Electric Power Group (Kansai):30%

- ITOCHU Corporation Group (Itochu):50%

- Siemens Group (Siemens):20%

◇ The Kansai Electric Power Co., Inc.

Establishment: 1951 President and Director: Takashi Morimoto Headquarters: 3-6-16, Nakanoshima, Kita-ku, Osaka, Japan Main Business: Energy generation, heat supply, telecommunications, gas supply, etc.

◇ ITOCHU Corporation

Establishment:1949 Chairman and CEO: Masahiro Okafuji Headquarters: 5-1 Kita-Aoyama 2-chome, Minato-ku, Tokyo, Japan Main Business: General trading company dealing in textiles, machinery, metals & minerals, energy & chemicals, food, general products & realty, ICT & financial business, etc.

◇ Siemens AG

Establishment: 1847 President and Chief Executive Officer: Joe Kaeser Headquarters: Munich, Germany Main Business: Building technology, digital factories, energy management, financial services, transportation, etc.

<Profiles of Project Partners>

Table 1 KEPCO’s Operating Plants in the U.S.

[1] https://new.siemens.com/global/en/general/legal.html

[2] https://www.kepco.co.jp/corporate/pr/2020/pdf/0518_2j_01.pdf

[3] https://www.itochu.co.jp/en/about/profile/index.html

[4] https://www.tyrenergy.com/about/

[5] https://www.kepco.co.jp/corporate/pr/2020/0518_2j.html

[6] https://www.kepco.co.jp/english/corporate/pr/2020/pdf/may18_2.pdf

[Japan] Hokuriku Electric Power Accelerates Investment by Entering Overseas Power Business

Hokuriku Electric Power (Rikuden, Headquarters: Toyama City, Toyama Prefecture), released its 2030 Long-Term Vision Plan and Medium-Term Management Plan (2020 version) in April 2020. The 2030 Long-Term Vision sets a goal of investing more than 200 billion yen (approximately $1.9 billion[1]) through Fiscal 2030 as part of its growth strategy. Rikuden identified three strategic areas of growth to accelerate investment: 1) supporting the local community through addressing challenges, 2) creating new services through a fusion of existing assets and new technology, and 3) entering overseas power businesses. [2]

As part of its efforts to invest in overseas energy businesses, on April 21, 2020, Rikuden announced its investment in Japan Energy Capital 1 L.P., which targets overseas renewable energy business in Turkey and Jordan as well as energy technology venture companies in Europe and the U.S. It is Rikuden’s first overseas business investment. [3] On April 30, 2020, Rikuden further announced that it will establish Hokuriku Electric Power Business Investment G.K. in June 2020. The subsidiary will focus on accelerating investments in Rikuden’s strategic areas of growth. According to Rikuden, it will continue to cultivate new business opportunities and make investments to accelerate its growth. [4]

[1] ¥ 1 = $ 0.0094 USD. Based on the exchange rate as of May 8th, 2020.

[2] http://www.rikuden.co.jp/press/attach/19042502.pdf

[3] http://www.rikuden.co.jp/press/attach/20042101.pdf

[4] http://www.rikuden.co.jp/press/attach/20043003.pdf

[Japan] Hokkaido Electric Power Released the Hokuden Group Management Vision 2030

On April 30, 2020, Hokkaido Electric Power (HEPCO, Headquarters: Sapporo City, Hokkaido) released its “Hokuden Group Management Vision 2030.” HEPCO transferred its Power Transmission & Distribution Division to the newly established “Hokkaido Electric Power Network " to legally separate the transmission and distribution divisions on April 1, 2020. The business split was implemented to comply with the Electricity Business Law Amendment Bill enacted in June 2015 (Act No. 47 of 2015). This is a major turning point because even after the split, both companies will still collaborate to supply electricity. The Management Vision discusses HEPCO’s plans on how the two companies will collaborate to provide stable electricity and its business plans in response to the changes in the business environment, including intensifying competition, advancements in technology, climate change issues, and an aging society.

The Management Vision 2030 sets two phases before and after the restart of HEPCO’s Tomari Nuclear Power Plant. The target profit of phase 1 will be 23 billion yen (approximately $215 million) and phase 2 will be 45 billion yen (approximately $422 million) [1]. HEPCO aims for the early restart of the Tomari Nuclear Power Plant to achieve a more balanced generation mix in terms of S+3E (Safety + Energy Security, Economic Efficiency, and Environment). HEPCO’s goal is to reduce CO2 emissions by half or more by FY2030, which is equivalent to 10 million tons or more/year (FY2013 baseline), through the restart of Tomari Nuclear Power Plant and an increase in renewable energy, as well as the use of Liquefied natural gas (LNG) fired thermal power. HEPCO’s three reactors at Tomari Nuclear Power Plant have been shut down since the Fukushima accident, waiting for the regulatory approval for the restart.

HEPCO will also facilitate its business growth through expanding its business outside of the Hokkaido area and overseas, and by entering into new businesses that utilize digital technologies, such as IoT and drones in a wide range of sectors, including transportation and real estate. HEPCO will also strengthen its resiliency against natural disasters. The newly established Hokkaido Electric Power Network will play a critical role in ensuring the secure and stable supply of electricity. [2] [3]

[1] ¥ 1 = $ 0.0094 USD. Based on the exchange rate as of May 8 th, 2020.

[2] https://www.hepco.co.jp/info/2020/1250852_1844.html

[3] https://wwwc.hepco.co.jp/hepcowwwsite/info/2020/__icsFiles/afieldfile/2020/04/30/management_vision_2030.pdf

[Japan] Hokuriku Electric Power Accelerates Investment by Entering Overseas Power Business

Hokuriku Electric Power (Rikuden, Headquarters: Toyama City, Toyama Prefecture), released its 2030 Long-Term Vision Plan and Medium-Term Management Plan (2020 version) in April 2020. The 2030 Long-Term Vision sets a goal of investing more than 200 billion yen (approximately $1.9 billion[1]) through Fiscal 2030 as part of its growth strategy. Rikuden identified three strategic areas of growth to accelerate investment: 1) supporting the local community through addressing challenges, 2) creating new services through a fusion of existing assets and new technology, and 3) entering overseas power businesses. [2]

As part of its efforts to invest in overseas energy businesses, on April 21, 2020, Rikuden announced its investment in Japan Energy Capital 1 L.P., which targets overseas renewable energy business in Turkey and Jordan as well as energy technology venture companies in Europe and the U.S. It is Rikuden’s first overseas business investment. [3] On April 30, 2020, Rikuden further announced that it will establish Hokuriku Electric Power Business Investment G.K. in June 2020. The subsidiary will focus on accelerating investments in Rikuden’s strategic areas of growth. According to Rikuden, it will continue to cultivate new business opportunities and make investments to accelerate its growth. [4]

[1] ¥ 1 = $ 0.0094 USD. Based on the exchange rate as of May 8th, 2020.

[2] http://www.rikuden.co.jp/press/attach/19042502.pdf

[3] http://www.rikuden.co.jp/press/attach/20042101.pdf

[4] http://www.rikuden.co.jp/press/attach/20043003.pdf

[Japan] TEPCO Power Grid, Hokuriku Power Electric, Osaka Gas, and Saibu Gas Entered into a Capital and Business Alliance with Japan Infrastructure Waymark

On April 20, 2020, Japan Infrastructure Waymark (JIW, Headquarters: Osaka), which is wholly owned by Nippon Telegraph And Telephone West (NTT West, Headquarters: Osaka)[1] and provides infrastructure inspection solutions using drones, announced that it had entered into a capital and business alliance with four utility companies, TEPCO Power Grid (Headquarters: Tokyo), Hokuriku Power Electric (Headquarters: Toyama Prefecture), Osaka Gas (Headquarters: Osaka)[2], and Saibu Gas (Headquarters: Saitama Prefecture)[3]. In addition to the four utility companies, an IT solution provider, NTT Data (Headquarters: Tokyo)[4]; a Tokyo-based venture capital firm, Drone Fund[5]; and an engineering company, Toyo Engineering (Headquarters: Chiba Prefecture)[6] also joined the alliance.

Aging infrastructure and labor shortages are making it increasingly challenging for utility companies to efficiently inspect a large amount of infrastructure, such as power plants, transmission towers, and electric poles. The four utility companies and Toyo Engineering partnered with JIW to improve the efficiency of infrastructure maintenance work by developing Artificial Intelligence (AI) and drone solutions. The collaboration will develop AI and drone technologies for monitoring and inspection, ensuring more sophisticated, safe, and high-quality maintenance work. The alliance also facilitates sharing inspection expertise and enhanced AI solutions based on the collected data. [7] [8] [9] [10]

[1] https://www.ntt-west.co.jp/corporate/about/profile.html

[2] https://www.osakagas.co.jp/en/aboutus/corporate_profile/

[3] https://seibugas.com/wp/company_group/%E4%BC%9A%E7%A4%BE%E6%A6%82%E8%A6%81/

[4] https://www.nttdata.com/global/en/about-us/company-profile

[5] https://dronefund.vc/en/about/

[6] https://www.toyo-eng.com/jp/ja/company/outline/

[7] https://www.jiw.co.jp/20200420-infra-tieup/

[8] http://www.rikuden.co.jp/press/attach/200420001.pdf

[9] https://www.osakagas.co.jp/company/press/pr2020/1286672_43661.html

[10] https://www.tepco.co.jp/pg/company/press-information/press/2020/1539425_8615.html

[USA] Great River Energy to close 1.15 GW North Dakota coal plant

On May 7, 2020, Great River Energy, an electric transmission and generation cooperative in Minnesota, announced that it plans to significantly reduce its carbon footprint by replacing a North Dakota coal plant with renewable energy projects, market purchases and grid-scale battery technology.[1] Under the plan, the 1,151 MW Coal Creek Station would be retired in the second half of 2022 and 1,100 MW of wind energy would be purchased by the end of 2023. Great River Energy will also modify the 99 MW lignite coal-fired Spiritwood Station power plant to burn natural gas, install a 1-MW/150-MWh battery demonstration system, and repower its Blue Flint biorefinery with natural gas. According to the cooperative, the changes will significantly reduce member power supply costs, and will allow it to provide a 95% carbon-free energy portfolio.

Environmental activists praised the decision to close the Coal Creek Station, but North Dakota lawmakers are concerned that it will affect the state’s economy. North Dakota Governor Doug Burgum (R) said his administration is "more determined than ever to find a path forward for Coal Creek Station that preserves high-paying jobs. ... We remain committed to bringing stakeholders to the table to evaluate all options and find opportunity in this uncertainty."[2]

[1] https://greatriverenergy.com/major-power-supply-changes-to-reduce-costs-to-member-owner-cooperatives/

[2] https://www.governor.nd.gov/news/burgum-statement-great-river-energys-announcement-retire-coal-creek-station-2022